One of the hottest beverage categories are RTD mocktails. These spirit-free sips offer delightful non-alcoholic options that meet the growing customer demand. In addition to booze-free versions of traditional cocktails like margaritas and cosmopolitans, brands are creating a wide array of interesting and exotic offerings made from premium ingredients. These exciting new products are being brought to market not only by large corporations but by savvy entrepreneurs frustrated by the lack of options and see increasing, unmet consumer demand.

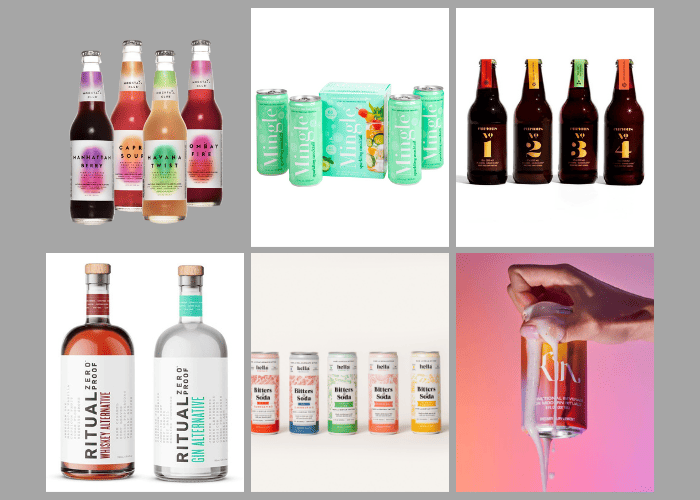

These exciting offerings by SKU alum Tenneyson‘s new plant-based non-alcoholic Black Ginger, a blend of ginger, dandelion, lemon balm, bergamot, Yerba Matte, and grape seed and SKU Dallas brand Hella Cocktail Bitters & Soda – premium sparkling non-alcoholic apéritifs in flavors like ginger turmeric and grapefruit made with spices like anise and allspice as well as bitter roots cultivated in the South of France. Mocktail Club boasts products like the Manhattan Berry, made with Blackberry, Pear Shrub and Ginger while Curious Elixirs sells a booze-free blend of lemon, cucumber, alpine flowers, herbs and ashwagandha.

To learn more about this trend, we spoke with beverage executive Paul Beaupre, a mentor for SKU Dallas brand Hella Cocktail, about this growing trend. Beaupre, a Coca-Cola veteran, is a beverage industry veteran, with expertise in a wide range of beverage categories.

Along the spectrum: From full strength to non-alcoholic

SKU: What is your definition of “sober curious?”

Beaupre: I prefer the term “booze optional,” which describes the growing trend of consumers who are continuously switching among full-strength, half-strength and alcohol-free drinks. We also see more and more people taking a month or two away from alcohol.

SKU: What makes a mocktail different from any other kind of non-alcoholic drink, such as a soft drink?

Beaupre: Great cocktails have complexity and balance among sweet, bitter, tart and the distinct attributes of the base spirit. It’s something that is sipped not chugged. I think a well-formulated alternative (such as Mocktail Club, Hella Cocktail, Ghia, BonBuz, Spritz Tea, and Casamara Club) offers consumers a great tasting, balanced option that is meant savored just like a well-crafted cocktail as a substitute for the occasions where some opt to drink alcohol. Many of these beverages work well with spirits added too, which is perfect for a growing booze-optional lifestyle.

SKU: What attributes make a non-alcoholic cocktail brand successful?

Beaupre: It’s many of the same things as brands from other categories / beverages:

- A strong and unique connection to its core consumers (great marketing)

- Great taste and consistent product quality

- A team and network who can build and steward the Brand

- A meaningful purpose / cause / mission

- Hard working packaging that communicates the brand values

- Excellent distribution and market execution

- The right price, package, channel plan

- Resources to do the above elements

SKU: When did the booze-optional trend begin to pick up?

Beaupre: In Europe, reduced-alcohol consumption and the increasing share of NA beer and NA cocktails started roughly a decade ago. NA beer represents 15 to 20 percent beer sales in some European countries. It seems that the wave hit the United States and started gaining market relevance in the last three to five years.

When you see Heineken and Budweiser put their names on zero-proof options, Coke and Diageo venture teams incubating NA Spirts (Seedip) and alcohol free cocktails (Bar None), and multimillion-dollar marketing campaigns behind those brands, these are strong indicators that this consumer base is viable and attractive in the United States. The valuations on Athletic Brewing, an amazing NA beer, further support this.

Leading retailers are beginning to merchandise their stores to better capture this shopper.

SKU: What factors do you think are driving this trend?

A evolving relationship with alcohol

Beaupre: There are a number of factors driving this:

- According to IWSR consumer research, 58 percent of consumers are drinking more non-alcoholic beverages than last year while 61 percent of consumers want better choices when it comes to NA drinks.

- Macro trends driven by COVID are driving “self care” and “mindfulness” behaviors resulting in people questioning the negative impact that over imbibing has on mental health, energy and emotional wellbeing.

- People want to be healthier and want to feel more in control. They also want to decrease the negatives that come with hangovers.

- Functional alternatives to alcohol such as cannabis are more readily available.

- The Gen Z population has a different relationship with alcohol and are more focused on clean leaving. They will continue to drive the category as they focus on health, environment and mission-based CPG brands.

SKU: Who is the target demographic for these RTD mocktails?

Beaupre: I think this trend is on an uptick across many demographics. But the biggest, most notable changes seem to be coming from the 25-35 year-olds with higher incomes. This group is starting to take on more work and family responsibilities. They want to be ready for activities there is not as much of a stigma stigma of not drinking compared to older generations. They are also experimenting with other options in place of alcohol. And they may want to avoid negative social media exposure.

SKU: Do you think this is a fad or a permanent trend?

Beaupre: Based on the leading demographic that has embraced this trend and their reasons for making these lifestyle choices. I would predict it will grow at an accelerated pace for the next decade and beyond.